Renters Insurance in and around Chicago

Your renters insurance search is over, Chicago

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

The place you call home is the cornerstone for everything you cherish. It’s where you build a life with your favorite people. Home is truly where your heart is. That’s why, even if you live in a rented home or condo, you should have renters insurance—even if your landlord doesn’t require it. It's coverage for the things you do own, like your boots and coffee maker... even your security blanket. You'll get that with renters insurance from State Farm. Agent Angelica Garcilazo can roll out the welcome mat with the dedication and skill to help you keep your belongings protected. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Your renters insurance search is over, Chicago

Coverage for what's yours, in your rented home

Renters Insurance You Can Count On

It's likely that your landlord's insurance only covers the structure of the home or apartment you're renting. So, if you want to protect your valuables - such as a desk, a set of golf clubs or a guitar - renters insurance is what you're looking for. State Farm agent Angelica Garcilazo can help you choose the right policy and insure your precious valuables.

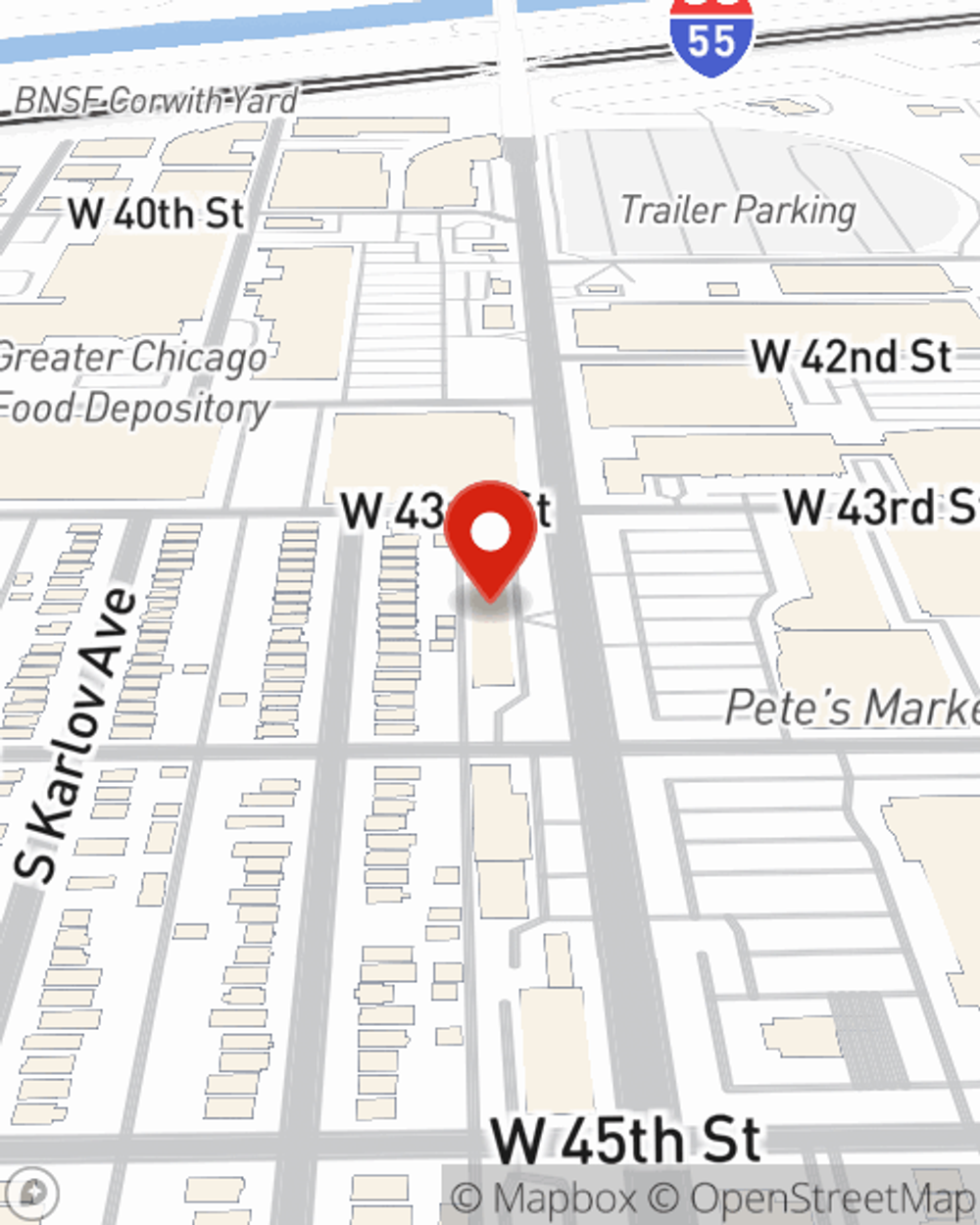

A good next step when renting a house in Chicago, IL is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online today and see how State Farm agent Angelica Garcilazo can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Angelica at (773) 565-4763 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Angelica Garcilazo

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.